Are Your Payment Processes Keeping Up?

The Need for Faster Cash Flow in a Challenging Healthcare Landscape

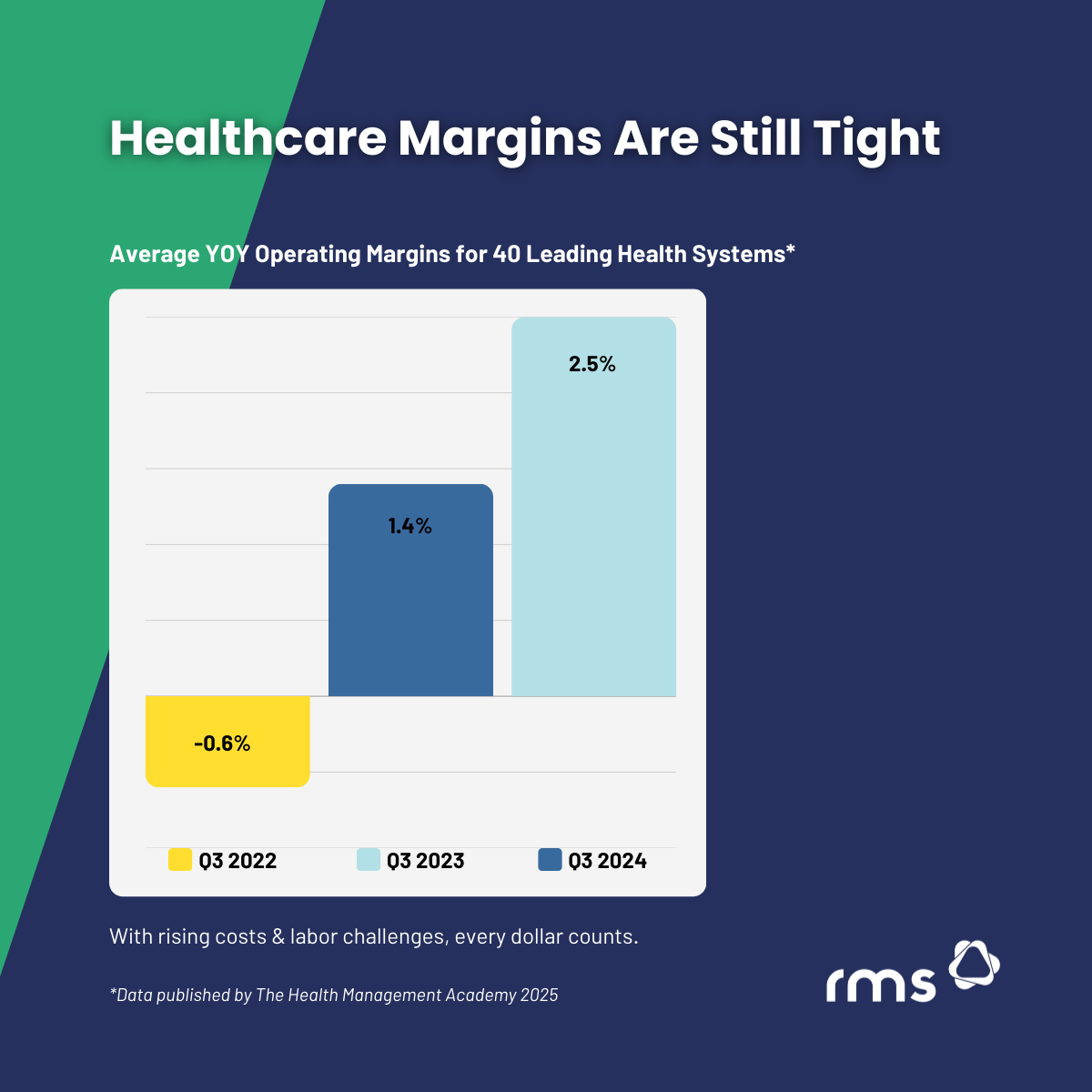

Healthcare operating margins may be improving, but major challenges remain. The latest insights from The Health Management Academy reveal that while average YOY operating margins for 40 Leading Health Systems have increased from -0.6% in Q3 2022 to 2.5% in Q3 2024, the sustainability of this trend is uncertain. The "75-75 conundrum" continues to pressure hospitals and health systems, where 75% of expenses are tied to labor and supplies, and 75% of revenue comes from fixed, flat, or declining sources like Medicare, Medicaid, and self-pay patients.

With staffing shortages persisting and cost pressures mounting, hospitals can’t afford inefficiencies in revenue cycle management. Faster payment processing and streamlined cash flow are more critical now than ever.

The Need for Speed in Claim Payments

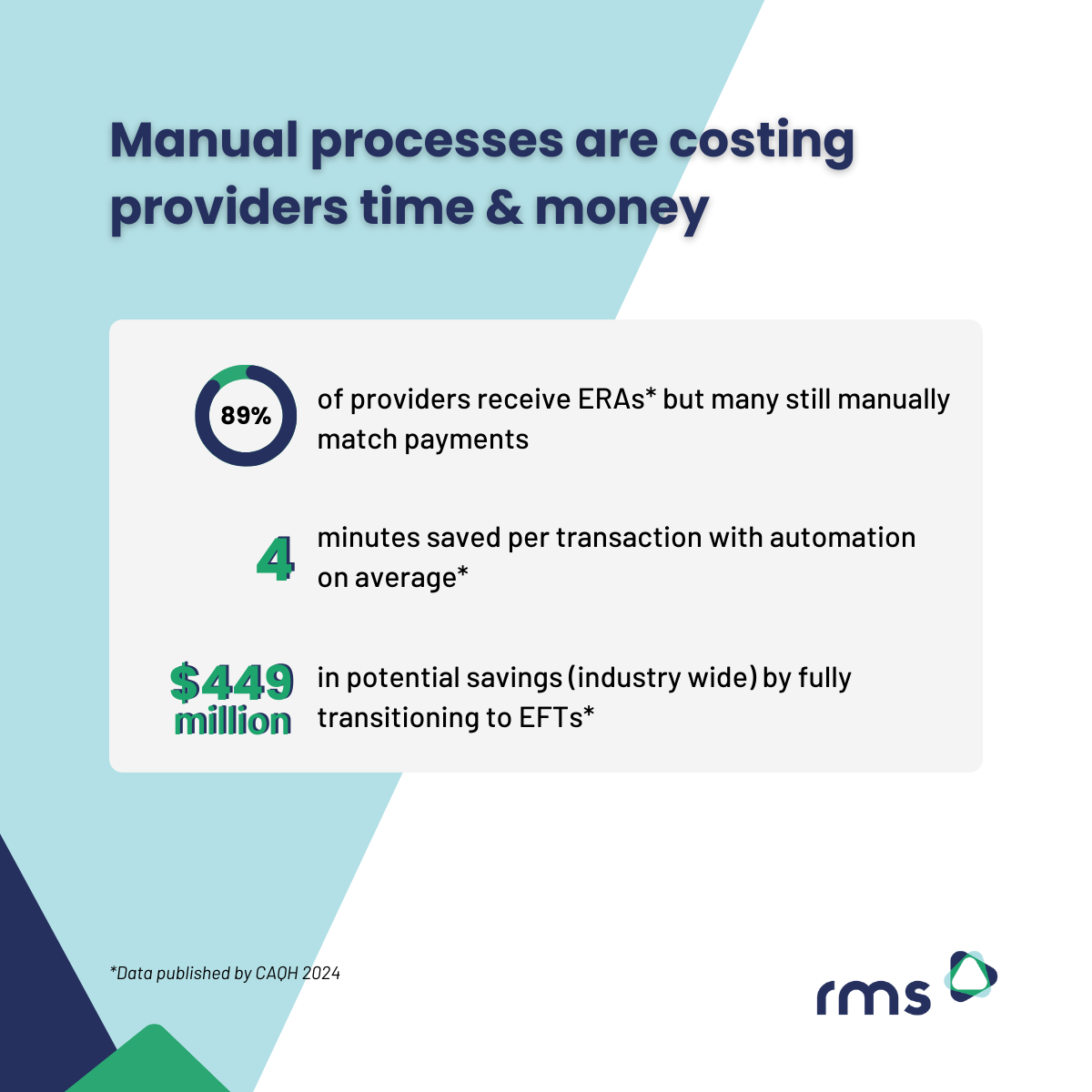

Health systems that rely on outdated payment methods risk cash flow delays that put further strain on already thin margins. The CAQH Index shows a 23% decline in check usage as more providers transition to Electronic Funds Transfers (EFTs). Yet, gaps in enrollment and manual processes still slow reimbursement cycles.

By fully adopting EFTs, the medical industry could save up to $449 million annually—money that could be reinvested in workforce retention, patient care, and operational stability. RMS helps providers optimize payer enrollments and eliminate payment bottlenecks.

Closing the Loop with ERA Reconciliation

While 89% of providers receive Electronic Remittance Advice (ERAs), many still manually match payments or deal with duplicate postings. These inefficiencies cost time, delay revenue recognition, and strain staff already stretched thin. Moving to fully automated ERA reconciliation could save providers an average of 4 minutes per transaction, easing administrative burden and improving financial clarity (CAHQ 2024 Index Report).

With RMS's advanced technology, providers can:

- Accelerate cash flow with seamless EFT and ERA enrollment

- Reduce reliance on paper-based processes and manual reconciliation

- Free up staff for higher-value tasks in an already constrained labor market

The Future of Healthcare Payments

Given the continued uncertainty around financial recovery, it's more important than ever that health systems ensure their revenue cycle keeps pace with economic realities. The shift to digital payments and automated reconciliation is a strategic imperative.

Are your payment processes keeping up? RMS is here to help optimize your revenue cycle and drive financial stability in an evolving landscape.

Discover how much RMS automation could save your organization. Contact us for a free ROI assessment: https://rmsweb.com/contact