The No Surprises Act: What It Means for Your Revenue Cycle

Since 2022, the No Surprises Act (NSA) has shielded patients from unexpected medical bills. Yet the same law has also created new challenges for hospitals and revenue cycle teams, from payer disputes to compliance requirements.

At its core, the NSA creates more rules to follow, more disputes to manage, and more opportunities for payment delays. For CFOs and revenue cycle leaders already dealing with denials, payer slowdowns, and tighter margins, it has become another pressure point that directly impacts cash flow. (CMS overview)

How the No Surprises Act Impacts the Revenue Cycle

- More disputes with payers: When providers and insurers cannot agree on payment amounts, the case goes into a formal dispute process. That adds paperwork, deadlines, and weeks of waiting before payment is resolved. (AMA report)

- Delayed reimbursements: Insurers now have a longer window to respond before billing can move forward, slowing down the revenue cycle.

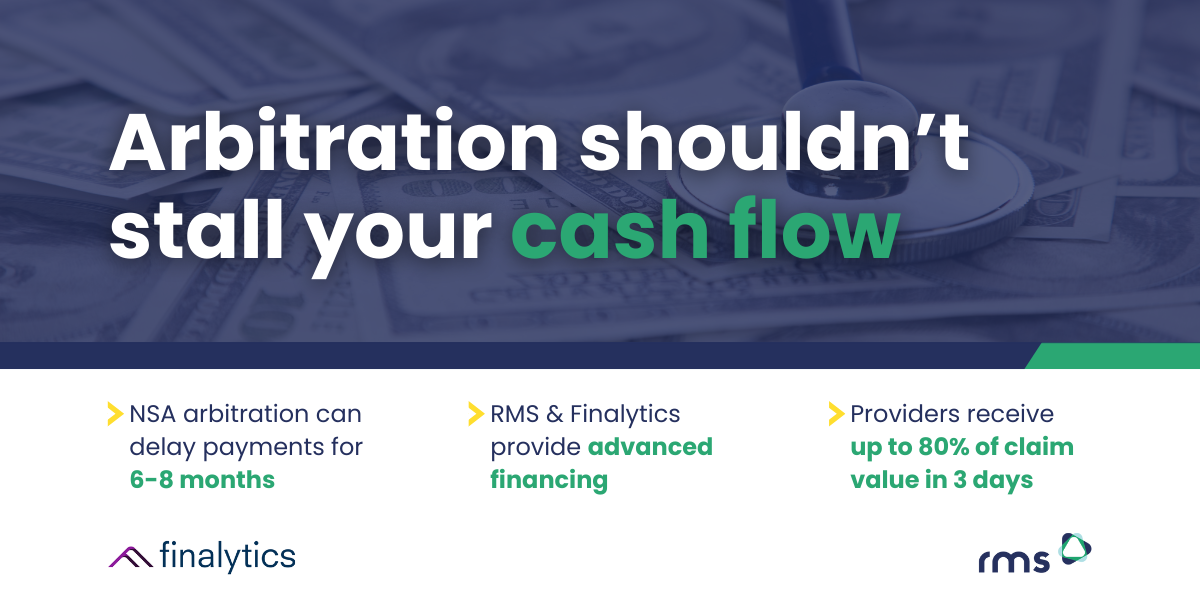

- Arbitration delays: Claims that reach arbitration can remain unresolved for six to eight months or more. During that time, millions of dollars may be tied up, creating serious cash flow challenges for providers.

- Heavier administrative burden: Good Faith Estimates, compliance checks, and reporting requirements all add more work for billing teams.

- Lost revenue opportunities: Out-of-network payments often come in lower than expected, and missed filing windows can mean dollars left behind.

Not every challenge falls inside a hospital’s control, but many of them do tie back to payment accuracy, reconciliation, and automation. That’s where the right RCM partner makes the difference.

Simplifying Compliance Through Better Payment Processes

At RMS, we can’t change the law, but we can help providers navigate it without losing focus on financial health.

Here is how we help:

- Accurate reconciliation: Our automation matches deposits to remits quickly and cleanly, reducing errors that can trigger disputes or compliance problems.

- Faster posting: By converting EOBs and PDFs into ready-to-post files, payments hit your system and your account without unnecessary delay.

- Relief during arbitration: Through our partnership with Finalytics, RMS helps providers access advanced financing on arbitration claims. Instead of waiting six to eight months for a resolution, providers can typically receive up to 80% of the claim value within three days, giving them the working capital needed to manage operations, payroll, and patient care.

- Leverage documentation: Our technology bundles, stores, and indexes payment documents so they can be easily recalled for arbitration, payer discussions, or compliance checks.

- Scalable support: Whether volumes spike from disputes or from everyday billing, our onshore team and technology scale with you.

The Bottom Line

The No Surprises Act is here to stay, and enforcement is only getting stronger. For providers, that means more pressure on revenue cycle teams to keep payments accurate, compliant, and moving forward.

RMS helps healthcare organizations simplify the process, support arbitration relief, and maintain cash flow so teams can focus less on red tape and more on results.

Want to see how automation can help your team stay ahead? Contact us here.